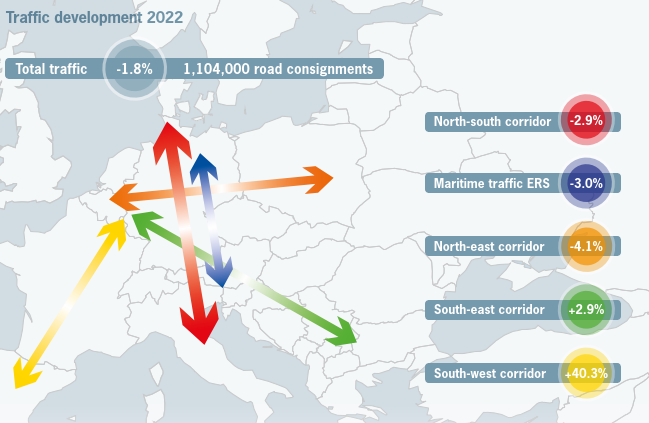

The traffic volume of the Hupac Group stagnated at 1,104,000 road consignments in 2022. Nevertheless, Hupac achieved a satisfactory financial result. Transport policy support measures are necessary to stabilise combined transport in the current economic downturn.

Traffic development in 2022 below expectations

Last year, the Hupac Group carried 1,104,000 road consignments in combined road/rail and seaport hinterland transport, which corresponds to a slight decrease of 1.8% or 20,000 road consignments. Capacity bottlenecks in Germany in particular had a negative impact. After a strong first quarter with monthly growth rates in the high single digits, traffic slumped in April and June and again in the autumn due to intensive construction activity on the Rhine-Alpine corridor. At peak times, up to 20% of the ordered trains could not run for operational reasons. In the last quarter, an economic slowdown set in due to the unfavourable development of energy prices.

Overall, traffic on the high-volume north-south corridor decreased by 2.9% to 767,000 road consignments. Transalpine traffic through Switzerland declined by 2.1% to 585,000 shipments. In contrast, transit traffic through Austria developed positively with an increase of 9.7% to 44,000 shipments. The south-east and south-west corridors also developed positively with growth rates of 2.9% and 40.3% respectively.

Seaport hinterland traffic also continues to be subject to strong external influences. Keywords here are the global supply chain disruptions caused by COVID-19 with shutdowns in Asia and the uncertainties caused by the war in Ukraine. ERS Railways' maritime traffic from the North Sea ports declined by 3% to 184,000 road consignments.

The turnover of the Hupac Group decreased by 2.1% to CHF 668.5 million. With a net profit of CHF 7.6 million, Hupac nevertheless achieved a satisfactory annual result. Investments reached a high level of CHF 84.3 million as various projects could be resumed after the pandemic break.

Weak economy with ongoing capacity issues

Due to high energy costs, energy-intensive industries such as steel, chemicals and paper are particularly under pressure. Hans-Jörg Bertschi, Chairman of the Board of Directors of Hupac Ltd, explained at the annual media conference in Zurich that the base load of combined transport in Europe is falling with the decline in these rail-related transports. In addition, since January 2023, price increases for rail transport in Europe have been significantly higher than those for road transport. At the same time, as the industrial economy stagnates or declines, significant capacity is again available in road transport. This leads to a significant shift of transport from rail to road. In Hupac's transport network, this can be quantified as a minus of 10 to 15 percent for the period January to April 2023 compared to the same period of the previous year, depending on the transport segment.

“The sum of negative factors such as the decline in traffic due to the economic situation, high rail costs, falling road freight rates and the chronic instability of the rail network represent a real risk of modal shift,” says Bertschi. Although the volume of combined transport in Europe fell significantly in the first quarter, the quality and reliability of the international rail infrastructure has hardly improved. Too many trains are still canceled or delayed for days. "If the reliability of the rail infrastructure and the quality of combined transport do not improve, we can expect a further shift back to the roads in the coming months.”

Measures to stabilise the modal shift

Hupac keeps its transport network stable despite a decline in demand. Where necessary, operational concepts are being optimised and overcapacities reduced. Strict cost management in cooperation with its partners helps to overcome the crisis with lean structures and flexible production planning.

However, whether combined transport will be able to maintain its market position in the current situation and, if possible, expand it, depends above all on the transport policy framework. Hupac President Hans-Jörg Bertschi lists a number of measures that would strengthen the marketability of combined transport and secure the successes achieved so far:

- Quality management for shuttle trains in international Alpine transit

Introduction of a consistently effective operational management for international Alpine transit trains of combined transport on the Rhine-Alpine corridor under the management of the corridor's railway infrastructures - a measure that is particularly urgent in view of the forthcoming corridor renovations and construction work on the Rhine Valley Railway. Because of its importance for transport policy in this corridor, Switzerland would have a leading role in providing impetus. This would be done with the support of Italy, which urgently needs a functioning transalpine transport system to safeguard its economy and foreign trade.

- Support for the competitiveness of combined transport

Temporarily suspend the annual reduction of subsidies for combined transport until the economic crisis is over. By adjusting the subsidy to the reduced transport volume in the first quarter of 2023, the loss of competitiveness of combined transport can be partially compensated.

- Continuation of the Rolling Highway until 2028

The Rolling Highway is currently very well used due to the increase in road traffic. The continuation of the Rolling Highway service until 2028 is an appropriate measure to counteract the shift back to pure road transport.

- Improving performance through digital transformation

A transparent flow of data along the entire combined transport service chain helps to ensure that capacity is better used and that individual partners can plan better. Existing open systems such as DX Intermodal's Data Hub must become the standard for all combined transport in Europe.

Outlook: investments secure climate-friendly intermodal transport

Despite the current difficult situation, Hupac is maintaining its investments in terminals, IT systems and network expansion, thus securing the conditions for future growth. “We welcome the positive decision of the Swiss Ministry of Transport to finance the major terminal Milano Smistamento, which Hupac will realise in a joint venture with Mercitalia Logistics by 2026,” emphasises Michail Stahlhut, CEO of the Hupac Group. This new central gateway terminal in Milan will significantly accelerate the ongoing development of seaport hinterland traffic from the Italian ports to Switzerland and southern Germany.

Other Hupac terminal projects are already in the realisation phase, such as the Piacenza terminal to be completed by 2025, the extension of the Novara terminal and the replacement investments in gantry cranes at the Busto Arsizio-Gallarate terminal.

In terms of network development, Hupac is focusing on the expansion of services from the Köln Nord terminal, the operation of which was taken over by the Hupac Group at the beginning of the year. The new Brwinów terminal near Warsaw is being developed as a hub for transports to/from western and southern Europe. In the core market of transalpine transport through Switzerland, the focus is on the Benelux markets and the economic areas of north-eastern, central and southern Italy. In maritime transport, the Hupac Group pursues a long-term strategy based on its European network. While the northern ports are served by the subsidiary ERS Railways, Hupac Intermodal makes its network available for volumes from the Mediterranean ports.

“We are convinced that our competitive, market-oriented combined transport products offer real added value for environmentally and climate-friendly logistics,” says Stahlhut. Compared to pure road transport, the Hupac network saved around 1.5 million tonnes of CO2 in 2022, reduced energy consumption by 17 billion megajoules and took 21 million tonnes of goods off the roads. Says Stahlhut: “Our long-term corporate strategy is part of the answer to the major challenges facing society, such as climate protection, energy transition and sustainable economic development. We will continue to focus on this in the current year.” |